Tax Exemption Services

Tax Exemption & Financial Record Keeping

- Obtaining federal & state tax exemptions (501c3)

- Filing Form 990 (federal tax returns)

- Preparing monthly and annual financial records

- Filing the Fire District’s annual financial form (AUD)

Fire departments and ambulance services can check the following three sites to learn about their corporation.

Check the Department of State website to determine if you are utilizing the correct corporate name or if the department/service is incorporated.

Check Guidestar to determine if the corporation is exempt as a 501(c)(3) or 501(c)(4) and if it is filing tax returns.

Financial Record Keeping

Few tasks are more difficult and more important than maintaining accurate financial records. The Pinsky Law Group maintains monthly financial records for our clients (fire departments, fire districts and ambulance companies) and provides up to date and accurate financial reports for the membership and board of directors. Contact Nicole to see how she can help your organization stay organized and improve accountability.

E-mail [email protected] for more information.

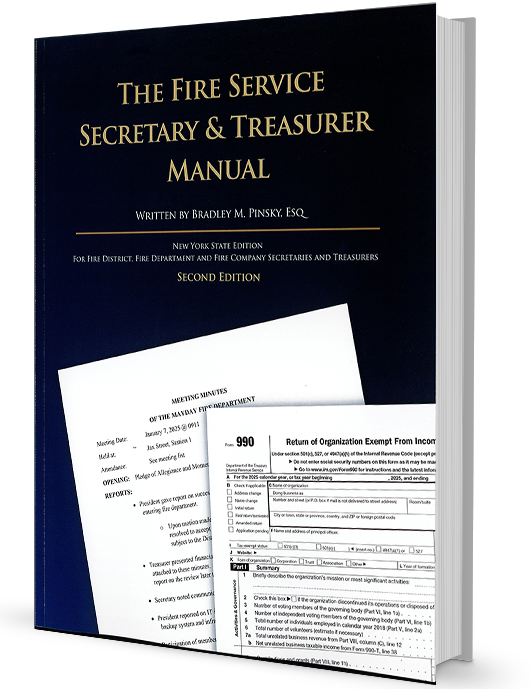

Get the Manual written just for Treasurers and Secretaries of Fire Companies and Fire Districts!

Written just for Treasurers (and Secretaries) of Fire Districts, Fire Departments and Fire Companies, this Manual reviews all of the laws that govern your job and provides sample best practices, policies, accounting rules and notices that you need!

PLEASE NOTE: That the financial and book keeping services offered by the Pinsky Law Group, PLLC are not likely to be privileged or confidential or protected by the attorney/client privilege, as tax returns and other financial reports of public entities and not for profit corporations may be subject to public inspection, publication on a government website, or obtained under the Freedom of Information Act. Please note further that no client is required to utilize these services in conjunction with legal representation of the Pinsky Law Group, PLLC.